Corporate taxation in Switzerland is a fundamental consideration for any company operating in the country. Known for its transparent and business-friendly tax regime, Switzerland is a popular jurisdiction for international corporations and startups. However, the Swiss tax system is more complex than it may initially appear, involving federal, cantonal, and municipal levels of taxation that vary significantly across the country.

Understanding corporate tax obligations is crucial for ensuring compliance and maximizing tax efficiency. Staying up-to-date with changing tax regulations is particularly important given recent international developments, such as the OECD’s global minimum tax rate, which directly impacts the Swiss tax landscape.

This comprehensive guide aims to equip business owners, financial executives, and potential investors with the knowledge needed to navigate corporate taxation in Switzerland in 2024 effectively.

Overview of the Swiss Tax System

The Swiss tax system is structured in a unique way, incorporating three distinct levels of corporate taxation: federal, cantonal, and municipal. Each of these levels plays a specific role in determining the overall tax burden for businesses, resulting in a multi-layered approach to taxation that allows for both standardization and flexibility.

- Federal Level: At the federal level, Switzerland imposes a corporate income tax (CIT) at a flat rate of 8.5% on profit after tax. This tax is consistent across the country and serves as a foundation for corporate taxation in Switzerland. The federal rate is effectively reduced when it is accounted as deductible, leading to an approximate effective rate of 7.83% on pre-tax profits. The federal CIT is a key component of Switzerland’s tax framework, providing a stable source of revenue for the national government while ensuring uniformity in corporate taxation across cantons.

- Cantonal Level: Switzerland is divided into 26 cantons, each of which has the authority to determine its own corporate tax rates. This flexibility leads to significant variations in cantonal tax rates, depending on local policies and economic strategies. Cantonal taxes are levied not only on profit but also on capital in some cantons. This level of taxation allows cantons to adjust rates to attract businesses and promote local economic development, which has led to a competitive tax environment among cantons, with rates ranging from as low as 11.85% in some areas to over 21% in others.

- Municipal Level: In addition to federal and cantonal taxes, municipalities within each canton also levy their own corporate taxes. Municipal tax rates vary widely, even within the same canton, contributing to further differentiation in the overall tax burden based on a company’s location. Municipalities use these funds to provide local services, such as infrastructure and community development, which are essential for supporting local businesses.

The combination of federal, cantonal, and municipal taxation ensures a dynamic tax environment in Switzerland, where businesses benefit from the country’s overall stability while being able to choose from a range of tax jurisdictions. This system also encourages cantonal and municipal governments to adopt business-friendly policies to attract investment and promote economic growth. As a result, Switzerland has developed a flexible and competitive tax system, making it one of the preferred locations for businesses seeking a stable yet adaptable tax environment.

Detailed Analysis of Corporate Income Tax (CIT)

Corporate Income Tax (CIT) in Switzerland is levied at three levels: federal, cantonal, and municipal. This structure creates a combination of uniformity at the national level and variability at regional levels, which can significantly affect the overall tax burden depending on the location of the business.

Federal Corporate Income Tax

The direct federal corporate income tax is imposed at a flat rate of 8.5% on profit after tax. Since this tax is deductible for tax purposes, the effective rate on profit before tax is approximately 7.83%. The flat federal rate provides consistency across the country, which is essential for companies looking for a stable taxation framework. The federal CIT serves as the foundation of the corporate tax system in Switzerland, ensuring uniformity and predictability for businesses regardless of their canton.

Cantonal and Municipal Taxes

In addition to the federal tax, Switzerland’s cantonal and municipal taxes vary significantly. Cantonal taxes are set by each canton, leading to different rates that can range widely, influenced by local policies and economic development goals. Cantonal taxes are sometimes progressive, meaning higher profits are taxed at higher rates. Municipalities also impose taxes by applying local multipliers, adding another layer of complexity and variability. This flexibility allows cantons to create favourable conditions to attract businesses, which is why some cantons, like Zug, have established themselves as tax-friendly regions.

Tax Incentives Under TRAF

To enhance Switzerland’s competitiveness, the Federal Act on Tax Reform and AHV Financing (TRAF) introduced several tax incentives:

- Patent Box: The patent box allows income from intellectual property rights to be taxed at a reduced rate, complying with OECD standards. This encourages companies to conduct R&D activities in Switzerland.

- R&D Super Deductions: TRAF also introduced enhanced deductions for R&D expenses, which can be up to 150% of eligible costs, making Switzerland an attractive location for innovative companies.

- Hidden Reserves: The disclosure of hidden reserves is allowed during company relocations to Switzerland, providing favourable tax treatment to help businesses strategically plan their tax liabilities.

The following table summarizes key features of the Swiss corporate tax system:

| Feature | Details from the First Article | Details from the Second Article |

| Federal Corporate Income Tax Rate | Flat rate of 8.5% on profit after tax, deductible, effective rate ~7.83% | Flat rate of 8.5% on profit after tax, deductible, effective rate ~7.83% |

| Cantonal and Municipal Tax Variability | Varies by canton and municipality, specific rates in Geneva and others listed | Varies from canton to canton, imposed at progressive rates in some |

| Tax Deductions and Incentives | Mentions OECD-compliant patent box, R&D super deductions, hidden reserves | Patent box, R&D super deduction, and other measures since the Federal Act on Tax Reform and AHV Financing (TRAF) |

| Tax on Profits | Divided into federal profit tax (IFD) and cantonal/municipal profit tax (ICC) | Taxed on taxable profits at federal, cantonal, and communal levels |

| Capital Tax | Levied only by the cantons, the rate varies, no federal levy | Not mentioned specifically, implies no federal capital tax |

| Tax Treatment of Non-Resident Companies | Not specifically mentioned | Taxed if they have a PE, own real estate, are partners in a Swiss business, or deal in Swiss real estate |

| Progressive Tax Rates | Not mentioned | Applied in cantons that use progressive tax rates |

| Tax Reduction Measures | Not mentioned | Introduced internationally accepted measures such as patent boxes, super deductions under TRAF |

The multi-layered CIT structure in Switzerland, combined with various tax incentives, provides flexibility for companies seeking to strategically plan their tax burden. This makes Switzerland a favourable destination for companies involved in research, innovation, and international operations.

Capital Taxes and Their Impact

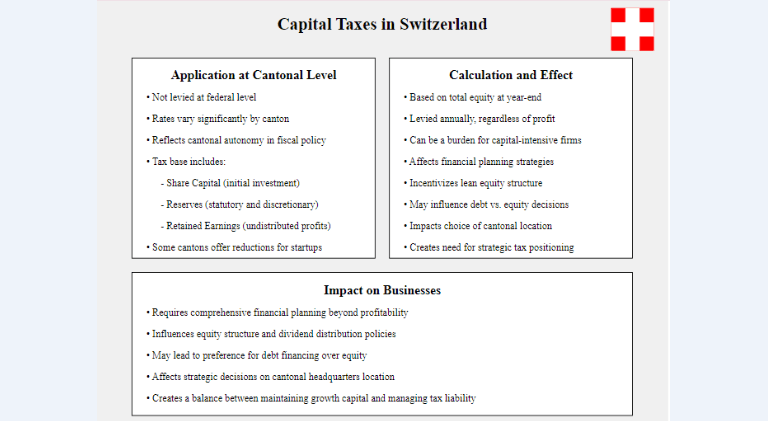

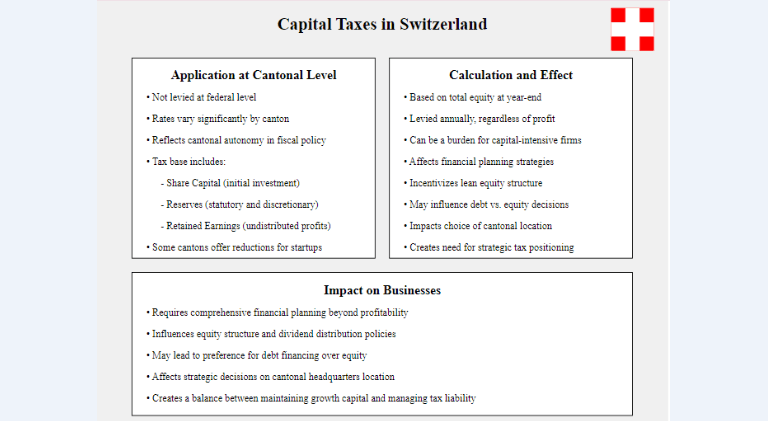

Capital taxes are an important component of the corporate tax landscape in Switzerland, specifically levied at the cantonal and municipal levels. Unlike corporate income tax, which is imposed on profits, capital taxes are applied to the equity of a company, encompassing share capital, reserves, and any retained earnings.

Application at the Cantonal Level

Capital taxes in Switzerland are not levied at the federal level; instead, they are exclusively imposed by the cantons, with rates and regulations varying significantly depending on the location. The variability in cantonal tax rates reflects the autonomy that each canton has in setting its own fiscal policies, which makes choosing the right canton for incorporation a strategic decision for businesses.

The tax base for capital taxes typically includes:

- Share Capital: The initial investment made by shareholders.

- Reserves: Funds allocated for future use, including statutory and discretionary reserves.

- Retained Earnings: Profits that have been retained by the company rather than distributed as dividends.

The actual rate of capital tax can differ greatly between cantons. For instance, cantons with more business-friendly environments, such as Zug or Lucerne, often offer lower capital tax rates to attract corporations, while other cantons may impose higher rates to generate more local revenue. Some cantons also provide reductions or exemptions for startups and businesses engaged in specific sectors, such as research and development, to stimulate economic activity and innovation.

Calculation and Effect on Businesses

The calculation of capital taxes depends on the total equity held by the company at the end of the financial year. For example, if a company has a significant amount of retained earnings, this will increase its taxable capital, potentially leading to a higher capital tax liability. Since capital taxes are levied annually regardless of whether a company makes a profit, they can create an additional financial burden, particularly for businesses that are capital-intensive or have large reserves.

Impact on Businesses:

- Financial Planning: Capital taxes require businesses to consider not just profitability but also the structure of their equity. High levels of retained earnings or reserves may increase a company’s tax burden, making effective financial planning essential to strategically plan the overall tax position.

- Incentive for Lean Equity: Companies often adjust their equity structure to reduce their exposure to capital taxes. This might involve distributing dividends more regularly to lower retained earnings or considering different funding structures, such as debt over equity, to strategically plan tax liabilities.

- Regional Variability: Since capital taxes vary by canton, companies often choose their location based on a combination of factors, including income and capital tax rates. Cantons offering lower or more flexible capital tax rates become particularly attractive to capital-heavy businesses and headquarters of multinational corporations.

The impact of capital taxes on a business is a balancing act between maintaining sufficient equity to support growth and managing the tax liability associated with that equity. Cantonal differences in tax rates provide both opportunities and challenges for companies looking to strategically position themselves within Switzerland. Businesses that can efficiently manage their equity and navigate the different cantonal tax structures stand to benefit the most from the country’s nuanced tax system.

Double Taxation and Its Avoidance

Double taxation is a significant consideration for corporations and shareholders operating in Switzerland. This phenomenon occurs when the same income is taxed twice—first at the corporate level when a company earns profit, and then again at the individual level when those profits are distributed to shareholders as dividends. In Switzerland, both corporations and shareholders are subject to taxation, which can result in an effective tax burden that is higher than what would be experienced if the income were taxed only once.

Double Taxation in Switzerland

In Switzerland, double taxation arises due to the separation between corporate entities and their shareholders:

- Corporate Level Taxation: Profits earned by corporations are subject to corporate income tax (CIT) at federal, cantonal, and municipal levels.

- Shareholder Level Taxation: When profits are distributed as dividends, shareholders are taxed on the income they receive. This leads to what is known as “economic double taxation,” as the same earnings are effectively taxed twice—once by the company and again by the shareholder.

For instance, a Swiss corporation pays federal, cantonal, and municipal CIT on its profits. If the remaining profit is distributed as a dividend, individual shareholders must include this dividend in their personal taxable income, subjecting it to income tax at their respective rates.

Avoidance and Mitigation of Double Taxation

Switzerland has implemented several measures to alleviate the impact of double taxation and ensure a fairer tax environment for businesses and investors. These measures are particularly important for encouraging investment and maintaining the attractiveness of Switzerland as a business hub.

- Partial Taxation Relief for Dividends: To mitigate the effects of double taxation, Switzerland offers partial taxation relief for qualifying dividend income. At the federal level, individual shareholders may be eligible for a reduced taxation rate on dividends, provided they hold a substantial participation (typically 10% or more) in the company. Many cantons also offer similar relief, which significantly reduces the effective tax burden on dividend income. This partial relief is designed to encourage long-term investment and promote reinvestment of profits into businesses.

- Double Taxation Treaties (DTTs): Switzerland has a broad network of double taxation treaties with over 100 countries. These treaties are designed to prevent international double taxation by specifying which country has taxing rights over certain types of income. For instance, if a Swiss subsidiary pays dividends to a parent company based in a treaty country, the treaty can reduce or even eliminate withholding tax on those dividends. This makes Switzerland an attractive location for multinational corporations that need to navigate complex cross-border tax scenarios.

- Tax Credit System: In cases where foreign income is taxed in another country, Switzerland may provide a tax credit to offset the taxes already paid abroad. This helps ensure that Swiss companies or shareholders do not pay taxes on the same income both in Switzerland and in the foreign jurisdiction. The tax credit system is particularly beneficial for Swiss companies with significant international operations, as it minimizes the overall tax burden on foreign-sourced income.

- Holding Company Privileges: Certain cantons in Switzerland provide favourable tax regimes for holding companies, which often benefit from reduced or even zero cantonal and municipal taxes on dividend income. These privileges help holding companies avoid double taxation at the cantonal level, thereby encouraging businesses to establish holding operations in Switzerland.

Example of Navigating Double Taxation

Consider a Swiss holding company that earns income from its subsidiaries located abroad. Without double taxation relief, the income distributed to the holding company would be taxed in the source country and then again in Switzerland. However, due to Switzerland’s extensive double taxation treaty network, the withholding tax in the source country could be reduced, and Switzerland may offer a tax credit to offset any remaining foreign tax. Additionally, at the cantonal level, the holding company may benefit from reduced taxation, ensuring that the same income is not taxed multiple times at different points in the corporate structure.

By leveraging measures like partial taxation relief, double taxation treaties, and cantonal privileges for holding companies, businesses can significantly mitigate the impact of double taxation. These strategies are essential for strategically planning tax efficiency, preserving shareholder value, and maintaining Switzerland’s position as an attractive jurisdiction for both local and international investors.

Tax Benefits and Deductions

Swiss companies benefit from a range of tax deductions and allowances designed to reduce their overall tax burden and promote investment, innovation, and economic growth. By taking advantage of these opportunities, businesses can significantly strategically plan their tax liabilities, thereby improving their financial health and competitiveness.

Key Deductions and Allowances Available to Swiss Companies

- Research and Development (R&D) Super Deductions: Under the Federal Act on Tax Reform and AHV Financing (TRAF), Swiss companies are entitled to enhanced deductions for R&D expenses. Cantons have the discretion to allow R&D costs to be deducted at up to 150% of the actual expenditure. This measure aims to incentivize innovation, particularly in sectors such as technology, biotechnology, and pharmaceuticals, making Switzerland an attractive location for companies heavily engaged in R&D activities.

- Patent Box: Switzerland offers a patent box regime that allows income derived from qualifying patents and intellectual property (IP) rights to be taxed at a reduced rate. This OECD-compliant measure is designed to encourage companies to develop and exploit IP within Switzerland. The income from IP included in the patent box benefits from a lower effective tax rate at the cantonal level, providing significant savings for innovative companies that heavily invest in intellectual property.

- Depreciation and Amortization: Companies are allowed to depreciate the value of their tangible and intangible assets over time, thereby reducing their taxable profit. Swiss tax law permits accelerated depreciation in certain cases, such as for newly acquired machinery or technology investments, which can provide substantial tax relief in the early years of an asset’s life.

- Hidden Reserves: Switzerland allows companies to create and use hidden reserves, which can be an effective tool for strategically planning tax liabilities. Hidden reserves are typically the difference between the market value and book value of a company’s assets, which are not fully disclosed in the financial statements. Upon relocation to Switzerland or during business restructuring, hidden reserves can be disclosed and taxed at a favourable rate, providing a strategic advantage for businesses looking to plan their tax positions effectively.

- Interest and Financing Costs: Interest expenses on loans taken out to finance business activities are generally deductible, which can help reduce taxable profits. This deduction encourages companies to make use of debt financing, particularly in industries that require significant capital investments. Swiss tax authorities are particularly favourable to loans that are used for productive investments, thereby enhancing companies’ ability to expand and grow.

- Charitable Contributions: Donations to qualifying charitable organizations are deductible from taxable income, provided they meet specific criteria set by Swiss tax law. This not only provides tax savings but also encourages corporate philanthropy and social responsibility within the business community.

- Loss Carryforward: Swiss tax law permits companies to carry forward losses incurred in previous years for up to seven years. This allows businesses that have experienced challenging periods to offset future profits, thereby reducing their tax burden when the business starts to generate positive earnings. However, loss carrybacks are generally not permitted under Swiss law.

Strategies for Strategic Tax Planning

- Strategic Use of Hidden Reserves: Companies can leverage hidden reserves to strategically plan their tax positions, particularly during mergers, acquisitions, or relocations. By maintaining assets at a lower book value, businesses can reduce their taxable capital and thereby decrease their capital tax liabilities. Later, when disclosing hidden reserves, the tax can be minimized by utilizing favourable conditions, such as lower tax rates during restructuring.

- R&D and Patent Incentives: Companies involved in R&D should ensure they take full advantage of the enhanced deductions available under TRAF. By structuring activities to qualify for R&D incentives, businesses can significantly reduce their taxable profits. Similarly, ensuring that IP is registered and utilized through the Swiss patent box regime allows companies to benefit from reduced taxation on the income generated by those assets.

- Debt vs. Equity Financing: Since interest payments on debt are tax-deductible, optimizing the ratio between debt and equity can provide companies with a way to reduce taxable profits. Properly balancing financing between loans and equity, within the limits allowed by Swiss thin capitalization rules, can lead to more efficient tax planning.

- Location Selection Within Switzerland: Choosing the right canton can greatly affect the effective tax rate for businesses. Cantons differ significantly in terms of their corporate income, capital taxes, and available deductions. Companies looking to establish or expand their operations in Switzerland should evaluate different cantons based on available tax reliefs, including patent boxes, R&D deductions, and favourable capital tax rates.

Swiss companies have various opportunities to lower their tax liabilities through deductions, allowances, and strategic tax planning measures. Leveraging these tax benefits, especially those introduced under TRAF, allows companies to focus on growth and reinvestment, thereby strengthening their market position and overall financial sustainability. Strategic tax planning, through mechanisms such as the use of hidden reserves, R&D super deductions, and careful financing decisions, is key for businesses aiming to minimize their tax burden while maximizing long-term value.

Comparison of Tax Rates by Canton

Switzerland’s unique tax system allows each canton to determine its own corporate tax rates, which results in a wide range of tax burdens across the country. This variability is a crucial factor for businesses deciding where to establish their operations, as the effective tax rate can significantly impact profitability. The following table provides a comparative overview of corporate tax rates by canton:

| Canton | Corporate Tax Rate (%) |

| Zug (ZG) | 11.85 |

| Nidwald (NW) | 11.97 |

| Lucerne (LU) | 12.20 |

| Glarus (GL) | 12.31 |

| Uri (UR) | 12.63 |

| Appenzell Innerrhoden (AI) | 12.66 |

| Obwald (OW) | 12.74 |

| Appenzell Ausserrhoden (AR) | 13.04 |

| Basel-Stadt (BS) | 13.04 |

| Thurgau (TG) | 13.21 |

| Neuchâtel (NE) | 13.57 |

| Schaffhausen (SH) | 13.80 |

| Fribourg (FR) | 13.87 |

| Geneva (GE) | 14.00 |

| Vaud (VD) | 14.00 |

| Schwyz (SZ) | 14.06 |

| St. Gallen (SG) | 14.40 |

| Graubünden (GR) | 14.77 |

| Solothurn (SO) | 15.29 |

| Jura (JU) | 16.00 |

| Valais (VS) | 17.12 |

| Aargau (AG) | 17.42 |

| Basel-Landschaft (BL) | 17.97 |

| Ticino (TI) | 19.16 |

| Zurich (ZH) | 19.65 |

| Bern (BE) | 21.04 |

Analysis of Cantonal Tax Rates

The cantons with the lowest corporate tax rates are Zug (11.85%), Nidwald (11.97%), and Lucerne (12.20%). These cantons are known for their competitive tax environments, which attract multinational corporations and startups seeking to strategically plan their tax liabilities. Zug, in particular, has established itself as a business hub, attracting numerous international companies and contributing to the region’s reputation as a “tax haven” within Switzerland.

Cantons like Glarus (12.31%), Uri (12.63%), and Appenzell Innerrhoden (12.66%) also offer relatively low tax rates, making them appealing locations for companies that prioritize a reduced tax burden. These regions combine lower tax rates with high quality of life and business-friendly administrative policies.

Geneva (14.00%) and Vaud (14.00%) are also relatively competitive, especially considering their strategic locations and excellent infrastructure. Although their tax rates are not as low as those in Zug or Nidwald, they offer significant advantages in terms of international connectivity and access to highly skilled labour.

On the higher end of the scale, Zurich (19.65%) and Bern (21.04%) have some of the highest corporate tax rates among Swiss cantons. Zurich, being the financial centre of Switzerland, offers other benefits such as excellent infrastructure, access to global markets, and a robust financial ecosystem, which can justify the higher tax rates for many businesses.

Choosing the Right Canton

When choosing a canton for incorporation, businesses need to consider not only the headline corporate tax rate but also other factors such as infrastructure, labour market, proximity to clients and partners, and available tax incentives like patent boxes and R&D deductions. For companies focused primarily on minimizing their tax burden, cantons like Zug, Nidwald, and Lucerne are particularly advantageous. These cantons combine low corporate tax rates with other incentives, creating a highly attractive environment for companies, especially those in the technology, finance, and innovation sectors.

By carefully selecting the canton that best aligns with their business needs, companies can achieve substantial tax savings and optimize their operational efficiency. The competitive tax environment in Switzerland allows for strategic positioning that not only minimizes tax liabilities but also provides access to a stable and highly developed business ecosystem.

Case Studies

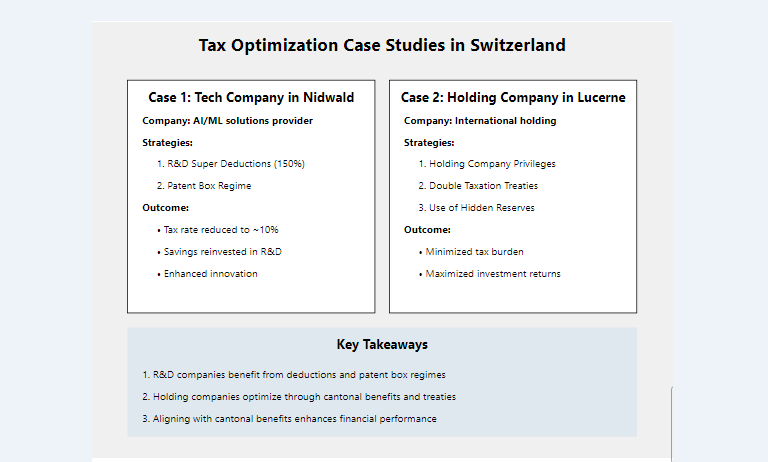

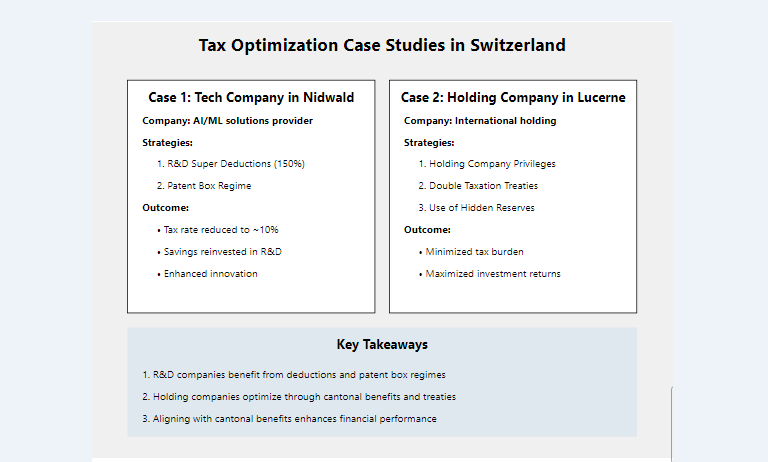

To illustrate how businesses can effectively manage their tax liabilities in Switzerland, we will explore two case studies involving companies that have leveraged Switzerland’s favourable tax environment to strategically plan their tax positions. These examples highlight different strategies, including the use of cantonal tax rates, R&D incentives, and favourable holding company provisions.

Case Study 1: Technology Company Leveraging R&D Super Deductions

Company Overview: This technology company specializes in artificial intelligence and machine learning solutions. Headquartered in the canton of Nidwald, the company focuses heavily on research and development to create innovative products for its clients across Europe.

Tax Planning Strategy: The company chose to establish its headquarters in Nidwald due to the canton’s competitive corporate tax rate of 11.97% and its robust support for R&D activities. The company leveraged the following strategies to strategically minimize its tax liabilities:

- R&D Super Deductions: Under the Federal Act on Tax Reform and AHV Financing (TRAF), the company utilized enhanced deductions for its R&D expenditures. Nidwald offers a super deduction of up to 150% for eligible R&D activities, which allows the company to significantly reduce its taxable profits. This enhanced deduction covered the salaries of R&D staff, costs associated with equipment, and expenses related to the development of new AI algorithms.

- Patent Box: The company also made use of the patent box regime available in Nidwald. By registering the intellectual property (IP) developed from its R&D efforts in Switzerland, the company benefited from a reduced effective tax rate on income derived from patents. This strategy effectively lowered the company’s tax obligations on profits generated from its patented technologies, further enhancing its tax efficiency.

Outcome: By strategically locating in Nidwald and taking advantage of available R&D incentives and the patent box regime, the company managed to reduce its effective corporate tax rate to around 10%, well below the national average. The savings generated were reinvested into expanding the company’s R&D efforts, enabling further innovation and growth.

Case Study 2: Establishing a Holding Company in Lucerne

Company Overview: This international holding company has investments in several European subsidiaries across industries ranging from finance to manufacturing. The company chose to establish its holding structure in Lucerne, attracted by the canton’s favourable tax regime for holding companies.

Tax Planning Strategy: The company used several key strategies to strategically plan its tax position:

- Holding Company Privileges: Lucerne offers significant tax privileges for holding companies, including exemptions or reductions in cantonal and municipal taxes. Since the primary activity of the company was managing investments rather than conducting operational activities, it qualified for these privileges, allowing it to reduce its cantonal and municipal tax liabilities.

- Double Taxation Treaties: With investments across Europe, the company utilized Switzerland’s extensive network of double taxation treaties to mitigate withholding taxes on dividends received from its subsidiaries. By leveraging these treaties, the company was able to reduce or eliminate withholding tax in the source countries, thereby increasing the net return on its investments.

- Use of Hidden Reserves: During its initial setup in Switzerland, the company disclosed hidden reserves at a favourable rate, benefiting from the flexibility allowed by Swiss tax authorities during company relocations. This allowed the company to strategically plan its taxable capital and reduce its liability in the early stages of establishing operations in Switzerland.

Outcome: Through a combination of cantonal privileges for holding companies, the effective use of double taxation treaties, and strategic disclosure of hidden reserves, the company was able to significantly minimize its tax burden. The favourable conditions offered by the canton of Lucerne, coupled with Switzerland’s broad treaty network, allowed the holding company to achieve high tax efficiency and maximize the return on its investments.

Lessons Learned from These Case Studies

These two case studies demonstrate how different types of businesses can successfully manage their tax liabilities by leveraging Switzerland’s diverse tax incentives and the advantages offered by specific cantons:

- Companies engaged in research and development can benefit from enhanced R&D deductions and patent box regimes to reduce taxable profits.

- Holding companies can strategically plan their tax structures by establishing themselves in cantons that offer favourable tax treatment, while also utilizing double taxation treaties to reduce international tax obligations.

By aligning their operations with cantonal tax benefits and making use of Switzerland’s well-established tax incentives, both domestic and multinational businesses can effectively navigate and manage their tax liabilities, thereby enhancing their overall financial performance.

Expert Insights

To provide a deeper understanding of corporate taxation in Switzerland, we have gathered insights from Swiss tax experts and certified public accountants (CPAs) who have extensive experience in advising companies on navigating the complex Swiss tax landscape. Their expertise offers valuable perspectives on how businesses can effectively leverage tax incentives and minimize liabilities.

Insights from Swiss Tax Experts

Hans, Swiss CPA and Tax Consultant

“Switzerland’s multi-tiered tax system can be challenging, but it offers incredible opportunities for companies willing to strategically plan their tax positions. The key to success is leveraging cantonal tax variations and taking full advantage of tax incentives, such as the R&D super deduction and patent box regime. These measures were designed not only to enhance Switzerland’s competitiveness on the global stage but also to support companies focusing on innovation and technological advancement.”

Hans emphasizes that companies investing heavily in research and development should ensure they take advantage of the super deductions offered by many cantons. He notes that some cantons allow up to 150% of R&D expenses to be deducted, providing significant relief that directly impacts the profitability of innovation-focused enterprises.

Sandra, Head of Tax Advisory, Zurich Fiduciary Services

“Many businesses underestimate the value of proper canton selection when setting up in Switzerland. The effective corporate tax rate can vary by as much as 10% depending on the canton, which has a substantial impact on long-term profitability. Zug and Nidwald, for example, offer some of the lowest effective rates, making them ideal for businesses that prioritize tax efficiency.”

Sandra insights underline the importance of location selection in Switzerland. Cantonal differences are a fundamental aspect of corporate tax planning, and choosing a canton with a lower rate can provide a direct advantage. She points out that Zug, with its tax rate of 11.85%, remains a favourite for companies looking to minimize their tax burden while enjoying Switzerland’s political stability and business infrastructure.

Marco, Tax Attorney at Geneva

“For multinational corporations, the key to effective tax management in Switzerland is to utilize the network of double taxation treaties. Switzerland’s expansive treaty network helps businesses avoid international double taxation and ensures they retain more of their earnings from subsidiaries abroad.”

Marco highlights the importance of double taxation treaties for multinational corporations with foreign subsidiaries. By utilizing Switzerland’s treaties, companies can reduce withholding taxes on dividends, royalties, and interest, thereby strategically improving their cash flow and reducing the overall tax burden. This is particularly beneficial for holding companies, which often face challenges related to cross-border income.

Claudia, Senior Partner

“The introduction of TRAF has fundamentally changed the Swiss tax landscape, making it more competitive and appealing, particularly for companies focused on intellectual property. The patent box regime and deductions for R&D activities are essential tools that companies should use to lower their tax liabilities. These provisions not only reduce the tax burden but also encourage long-term investment in innovation within Switzerland.”

Claudia notes that the Federal Act on Tax Reform and AHV Financing (TRAF) has added a range of incentives to make Switzerland even more attractive for innovative businesses. She advises companies to carefully assess whether they can qualify for the patent box regime and take advantage of R&D deductions, as these tools can significantly reduce effective tax rates.

Summary of Expert Insights

The insights from Swiss tax experts highlight several key strategies for strategic corporate tax planning in Switzerland:

- Leveraging Tax Incentives: Utilize R&D super deductions and patent box regimes to reduce taxable profits, especially if the business is innovation-driven.

- Strategic Location Selection: The canton in which a company is incorporated plays a crucial role in determining the effective tax rate, with certain cantons providing substantial tax advantages.

- Avoiding Double Taxation: For multinational companies, using Switzerland’s extensive double taxation treaty network is essential for reducing the withholding taxes on income generated abroad.

These insights from experienced Swiss tax professionals underscore the importance of strategic tax planning, whether through choosing the right canton, taking advantage of available tax incentives, or navigating international tax complexities. By utilizing these strategies, businesses can significantly improve their financial outcomes while ensuring compliance with Swiss tax regulations.

Recent Changes and Future Outlook

The Swiss tax landscape is undergoing significant changes, driven by international tax reforms and evolving domestic policies. These changes are designed to align Switzerland with global standards while maintaining its competitive edge as a prime business destination. This section will explore the most recent changes in the Swiss tax regime and provide a forward-looking perspective on potential future developments.

Recent Changes in the Swiss Tax Landscape

Implementation of OECD’s Global Minimum Tax Rate

One of the most impactful changes in recent years is the adoption of the OECD’s global minimum tax rate of 15% for large multinational enterprises (MNEs). This initiative, part of the OECD/G20 Base Erosion and Profit Shifting (BEPS) project, aims to curb tax avoidance by ensuring that multinational corporations are subject to a minimum level of taxation on profits earned globally. Switzerland, as a member of the OECD and a major international business hub, has committed to implementing these new rules starting in 2024.

The 15% minimum tax rate will primarily affect multinational companies with consolidated annual revenues exceeding 750 million euros, and it will apply to income earned by subsidiaries located in Switzerland. To accommodate this requirement, Swiss authorities have introduced a supplementary tax to ensure that the combined federal, cantonal, and municipal tax rates reach the 15% threshold for these large corporations. While many cantons already have effective corporate tax rates close to this threshold, the new rules may lead to slight increases in tax burdens for affected businesses.

Federal Act on Tax Reform and AHV Financing (TRAF)

The TRAF, which came into effect in 2020, has been instrumental in reshaping the Swiss tax landscape. The reform was introduced to comply with international standards while providing new tax incentives to foster innovation and business activity in Switzerland. Key provisions include:

- Patent Box Regime: TRAF introduced a patent box at the cantonal level, allowing income from qualifying patents and similar rights to be taxed at a reduced rate, encouraging innovation-driven businesses to retain and develop intellectual property within Switzerland.

- R&D Super Deductions: The reform also enabled cantons to offer enhanced deductions of up to 150% for qualifying R&D expenditures, making Switzerland highly attractive for companies that heavily invest in research and development.

- Reduction of Cantonal Tax Rates: To maintain competitiveness, several cantons lowered their corporate tax rates in response to TRAF, ensuring Switzerland remains an attractive jurisdiction for both domestic and international businesses.

Corporate Social Responsibility and Environmental Taxes

Recent developments have also seen a growing emphasis on environmental sustainability. Swiss authorities are increasingly focusing on implementing environmental levies and tax incentives for green investments. For example, companies that adopt energy-efficient technologies or renewable energy sources may qualify for certain tax rebates or exemptions. This trend is expected to continue as part of Switzerland’s commitment to meeting international climate goals, potentially leading to new opportunities for businesses engaged in sustainability.

Future Outlook and Predictions

Increasing Alignment with Global Standards

As international tax standards evolve, Switzerland is expected to continue aligning its tax policies with OECD and EU requirements. The global minimum tax rate is just one example of how Switzerland is adapting its tax framework to maintain its position as a responsible and transparent financial hub. Experts predict that Swiss authorities will implement additional measures to strengthen compliance and transparency, particularly regarding profit shifting and tax base erosion.

Pressure on Competitive Tax Rates

While Switzerland remains competitive in terms of overall tax attractiveness, there is growing pressure to maintain cantonal and municipal tax rates at levels that attract foreign investment while complying with global minimum standards. To offset potential negative impacts on competitiveness, it is likely that Swiss authorities will introduce more targeted incentives for specific industries, such as technology, pharmaceuticals, and green energy, to attract and retain investment.

Expansion of R&D and Innovation Incentives

Many experts believe that Swiss tax policy will increasingly focus on fostering innovation and digital transformation. This could involve expanding the scope of R&D super deductions or introducing new incentives for companies investing in digital infrastructure and emerging technologies like artificial intelligence and biotechnology. Switzerland’s commitment to innovation is likely to be reinforced by additional measures that encourage startups and high-tech industries.

Focus on Sustainability and ESG-Related Tax Incentives

As part of the global move towards sustainability, Switzerland is likely to expand tax incentives aimed at encouraging companies to adopt environmental, social, and governance (ESG) best practices. Future reforms may include additional deductions or rebates for investments in carbon reduction technologies, energy efficiency, and other environmentally friendly initiatives. This trend aligns with Switzerland’s broader commitment to reducing carbon emissions and promoting sustainable economic growth.

Expert Opinions on Future Developments

Thomas, Swiss Tax Consultant:

“The introduction of the global minimum tax rate is undoubtedly a significant change for Switzerland, but the country has been proactive in maintaining its attractiveness as a business destination. We are likely to see increased incentives for R&D and digital transformation to counterbalance any negative effects of higher tax rates for multinationals.”

Martina, Partner:

“Swiss cantons will need to be creative in retaining their competitive edge, especially in light of the OECD reforms. I expect to see a greater focus on targeted incentives for specific sectors, including pharmaceuticals, green energy, and technology, to ensure that Switzerland remains a top choice for business investment.”

The Swiss tax landscape is adapting to align with international norms, such as the OECD’s global minimum tax rate, while still offering numerous incentives to foster innovation and competitiveness. The implementation of the TRAF, environmental incentives, and potential future reforms to promote R&D and sustainability are shaping Switzerland into a forward-thinking and responsible tax jurisdiction. By staying ahead of international tax developments and maintaining attractive conditions for businesses, Switzerland aims to remain a leading hub for international companies and investors.

Insights from ALPINEGATE Tax Experts

At ALPINEGATE Business Advisors, our team of seasoned tax experts understands the intricate details of Swiss corporate taxation. With ongoing reforms and the implications of international tax standards such as the OECD guidelines, navigating the Swiss tax landscape requires a robust strategy. Our advisors provide businesses with bespoke guidance on maximizing tax efficiencies across federal, cantonal, and municipal levels, ensuring that our clients not only comply with current regulations but also strategically plan their tax positions.

For international corporations and new startups in Switzerland, strategic tax planning is crucial. ALPINEGATE’s experts specialize in tailoring tax strategies that align with business objectives and operational models. We help companies explore beneficial tax regimes, take advantage of deductions and incentives, and navigate the complexities of cross-border taxation issues. For a deeper dive into how our tax consulting can transform your fiscal approach, visit our Tax Consulting Services.

Conclusion

Navigating the Swiss corporate tax landscape effectively requires understanding the multi-level tax system, including federal, cantonal, and municipal obligations, as well as leveraging various incentives like the R&D super deductions and the patent box regime. With recent changes, such as the introduction of the OECD’s global minimum tax rate and reforms under TRAF, strategic tax planning has become even more crucial for businesses aiming to minimize tax liabilities while optimizing growth.

At ALPINEGATE Business Advisors, our team of seasoned experts can help you navigate these complexities and create tailored strategies to align with your business objectives. For comprehensive, expert guidance on Swiss corporate taxation, reach out to us today and discover how we can help you achieve the most advantageous tax position for your company.

FAQ Section for Corporate Taxation in Switzerland

What is the corporate income tax rate at the federal level in Switzerland?

In Switzerland, the corporate income tax (CIT) at the federal level is levied at a flat rate of 8.5% on profit after tax. This tax is deductible, which means it reduces the taxable income, resulting in an effective tax rate on profit before tax of approximately 7.83%. The uniformity of the federal rate provides a predictable tax environment for companies operating nationally.

How do cantonal and communal tax rates vary across Switzerland?

Cantonal and communal corporate tax rates in Switzerland can vary significantly depending on the specific location of a company’s corporate residence. Each canton sets its own tax laws, which means the overall tax burden can range broadly, influenced by local policies and economic strategies. Some cantons offer lower tax rates as an incentive to attract businesses, which can lead to substantial differences in tax liabilities for companies operating in different regions.

Are there any specific tax deductions or benefits that companies in Switzerland can use to reduce their tax liability?

Swiss companies can benefit from several tax deductions and incentives aimed at reducing their taxable income. Notable among these are the OECD-compliant patent box, R&D super deductions, and various allowances for depreciation and hidden reserves. These measures are designed to encourage innovation and investment in Switzerland, helping companies to significantly lower their effective tax rates.

What is meant by 'double taxation' for corporations and shareholders in Switzerland, and how is it addressed?

Double taxation in Switzerland refers to the scenario where both corporations and their shareholders are taxed on the same earnings—once at the corporate level on profits, and again at the individual level on dividends. Switzerland addresses this issue through the use of agreements and tax treaties, as well as systems that allow for tax credits or deductions that mitigate the effects of double taxation, ensuring fair taxation practices.

What should companies consider when choosing a canton for their Swiss business operation in terms of taxation?

When choosing a canton for business operations in Switzerland, companies should consider the overall tax rates, including both profit and capital taxes. Additionally, they should evaluate specific tax incentives such as those for new technologies or research activities that may be more favourable in certain cantons. Companies often benefit from consulting with tax professionals or local fiduciary services to make well-informed decisions based on comprehensive comparisons of tax obligations and benefits across different cantons.