Switzerland is renowned as one of the world’s most attractive destinations for entrepreneurs and businesses. With its stable economy, robust infrastructure, and favourable taxation policies, the country offers a secure and efficient environment for companies of all sizes. From thriving financial centers like Zurich and Geneva to innovation hubs such as Basel and Lausanne, Switzerland consistently ranks high in global competitiveness and ease of doing business.

One of the first and most critical steps in establishing a business in Switzerland is selecting the right legal structure. The choice determines not only the operational framework of your company but also its tax obligations, liability protections, and credibility in the market. For entrepreneurs seeking a balance between flexibility and legal security, the Limited Liability Company (LLC), known locally as “GmbH” in German-speaking regions and “Sàrl” in French-speaking areas, stands out as a top choice.

The LLC structure combines the benefits of limited liability for shareholders with the simplicity of management and relatively low capital requirements. It is particularly well-suited for small and medium-sized enterprises (SMEs), family-owned businesses, and international entrepreneurs looking to establish a foothold in Switzerland’s dynamic economy. By providing clear governance frameworks and protecting personal assets, LLCs offer entrepreneurs the ideal foundation for sustainable growth in one of the world’s most stable business environments.

Whether you’re a local entrepreneur or an international investor, understanding the advantages and requirements of an LLC in Switzerland is the first step toward turning your business aspirations into reality.

What is an LLC in Switzerland?

A Limited Liability Company (LLC), known as “GmbH” in German-speaking regions and “Sàrl” in French-speaking areas, is one of the most common business structures in Switzerland. Governed by the Swiss Code of Obligations (Articles 772–827), an LLC is a separate legal entity with its own rights and obligations, distinct from its shareholders. This structure is designed to combine operational simplicity with limited liability protection, making it an ideal choice for entrepreneurs, small and medium-sized enterprises (SMEs), and family-owned businesses.

In an LLC, the shareholders’ liability is restricted to their contributions to the company’s share capital, providing significant personal asset protection. This structure also allows for flexible management, with at least one managing director required to reside in Switzerland to ensure local compliance. The minimum required capital for an LLC is CHF 20,000, which must be fully paid upon incorporation.

Below is a detailed comparison of the LLC and other common business structures in Switzerland, highlighting its unique advantages and differences.

| Feature | Limited Liability Company (LLC) | Public Limited Company (PLC) | Sole Proprietorship |

| Legal Entity | A separate legal entity with its own rights and obligations. | A separate legal entity ideal for large-scale businesses. | Not a separate legal entity; the owner is the business. |

| Liability | Shareholders’ liability is limited to their capital contributions. | Shareholders’ liability is limited to their shares. | Unlimited liability; the owner is personally liable. |

| Capital Requirements | Minimum CHF 20,000, fully paid at incorporation. | Minimum CHF 100,000 (CHF 50,000 must be paid initially). | No specific capital requirement. |

| Shareholders | Minimum of 1 shareholder (individual or legal entity). | Minimum of 1 shareholder, with the option for public listing. | Sole proprietor only. |

| Shareholder Visibility | Shareholders’ details are publicly available in the Commercial Register. | Shareholders remain anonymous unless they hold board positions. | Not applicable, as the owner is the sole participant. |

| Management | At least one managing director must reside in Switzerland. | Managed by a board of directors, at least one must reside in Switzerland. | Managed solely by the owner. |

| Operational Complexity | Simple structure; suitable for SMEs and family businesses. | More complex, with formalized governance and reporting. | Very simple; suitable for small, owner-managed businesses. |

| Taxation | Subject to corporate income tax and shareholder income tax on dividends. | Subject to corporate tax and shareholder income tax. | Profits are taxed as the personal income of the owner. |

| Flexibility in Ownership | Shares can be owned by individuals or legal entities. | Shares can be publicly traded or privately held. | Not applicable; no shares exist. |

| Setup Costs | Moderate (notary and registration fees typically CHF 3,000–5,000). | Higher (due to larger capital and stricter requirements). | Low, but lacks scalability and protections. |

| Ideal Use Case | Suitable for small to medium-sized enterprises, family-owned businesses, and entrepreneurs seeking liability protection. | Best for large corporations, international companies, or businesses planning to raise capital through public shares. | Ideal for freelancers, artisans, and small-scale operators. |

This table highlights the LLC’s unique position as a flexible and secure business structure, combining the liability protection of a corporation with the simplicity of a partnership. It’s particularly well-suited to the needs of entrepreneurs operating in Switzerland’s dynamic business environment.

Advantages and Disadvantages of an LLC in Switzerland

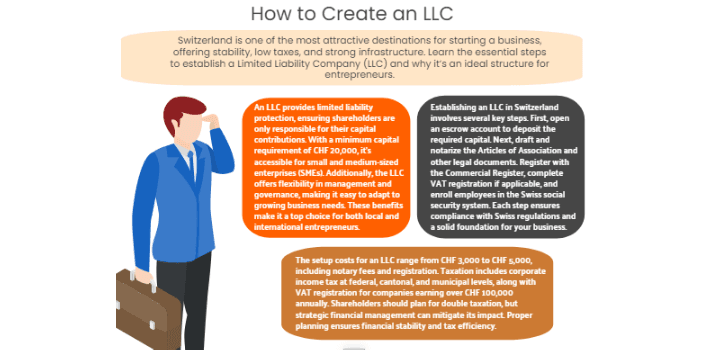

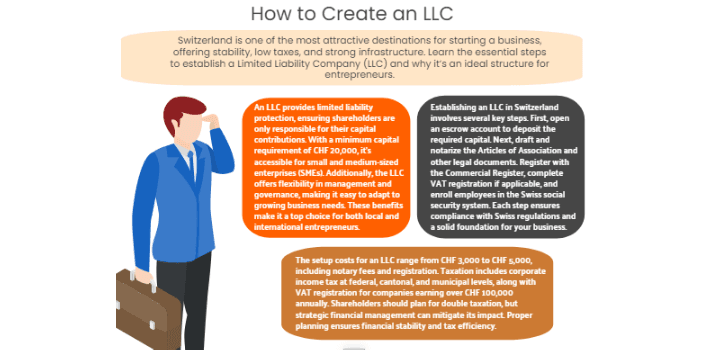

Choosing a Limited Liability Company (LLC) as your business structure in Switzerland offers several benefits, but it’s essential to weigh these against potential challenges. Below, we explore the advantages and disadvantages of establishing an LLC in Switzerland.

Advantages of an LLC

- Limited Liability for Shareholders

One of the most significant benefits of an LLC is the protection it offers to its shareholders. Their personal liability is limited to the amount of their capital contributions. This ensures that, in the event of financial difficulties or bankruptcy, the personal assets of shareholders remain secure, unless explicitly stated otherwise in the company’s statutes. - Relatively Low Capital Requirement

Compared to other business structures like Public Limited Companies (PLCs), the capital requirement for forming an LLC is much lower. The minimum share capital of CHF 20,000 makes it accessible for small and medium-sized enterprises (SMEs) and family-run businesses. Importantly, this capital is not locked and can be used for the company’s operations once it is incorporated. - Flexibility in Management and Shareholder Structure

An LLC can be formed by one or more individuals or legal entities, allowing entrepreneurs to operate alone or with partners. Adding new shareholders or investors is relatively straightforward, and the management structure is adaptable, enabling businesses to scale or pivot as needed. - Tax Benefits

Switzerland’s favourable tax policies extend to LLCs. For example, profits from the sale of LLC shares are not subject to capital gains tax. This makes the LLC structure particularly appealing to investors and entrepreneurs who may seek to sell or transfer ownership in the future. Learn more about tax advice services in Switzerland to optimize your business’s tax strategy.

Disadvantages of an LLC

- Higher Setup Costs Compared to Sole Proprietorships

While the LLC offers liability protection and a professional business structure, the initial setup costs are higher than for sole proprietorships. Expenses include notary fees, registration fees with the Commercial Register, and legal documentation, which typically range from CHF 3,000 to CHF 5,000. - Double Taxation for Shareholders

An LLC is subject to corporate income tax, and shareholders are taxed again on their personal income from dividends or salaries received from the company. This double taxation can reduce overall profitability, particularly for smaller businesses with limited revenue. - Lack of Anonymity for Shareholders

Unlike Public Limited Companies, where shareholders can remain anonymous, the names and details of LLC shareholders are publicly accessible in the Commercial Register. This lack of privacy may deter individuals who prioritize discretion in their business dealings. - Obligations for Auditing in Certain Cases

Swiss law requires LLCs to undergo a limited or ordinary audit if they exceed specific thresholds, such as having more than 10 employees or meeting certain financial criteria. This can lead to additional administrative and financial burdens for growing companies.

While an LLC in Switzerland offers significant benefits, such as liability protection and tax advantages, potential drawbacks like higher setup costs and public shareholder transparency should be carefully considered. Entrepreneurs are encouraged to evaluate their specific business needs and consult experts to determine if an LLC is the right fit for their goals.

Steps to Create an LLC in Switzerland

Establishing a Limited Liability Company (LLC) in Switzerland requires several formal steps. Each stage ensures compliance with Swiss regulations and sets the foundation for successful business operations.

Step 1: Open an Escrow Account

The first step in forming an LLC is to deposit the required share capital into an escrow account at a Swiss bank. The minimum share capital of CHF 20,000 must be fully paid before registration can proceed. Opening the escrow account involves providing the bank with identification and company information. For more guidance, explore our Swiss bank account opening services. Once the funds are deposited, the bank issues a capital confirmation certificate, which is a mandatory document for registration. After the company is registered and announced in the Swiss Official Gazette of Commerce, the escrow account is converted into a regular business account, making the funds available for operational use.

Step 2: Draft Articles of Association and Legal Documents

The foundational documents of the LLC, including the Articles of Association, must be carefully prepared to outline the company’s purpose, structure, and governance. These documents also include a deed of incorporation and any additional legal certifications. A Swiss public notary plays a crucial role in this step, certifying the documents to ensure compliance with Swiss legal standards. Legalization of signatures for all founders and directors is also required at this stage, further solidifying the company’s legitimacy.

Step 3: Register with the Commercial Register

Once the foundational documents are complete, they must be submitted to the relevant Cantonal Commercial Register. The submission includes the notarized documents, the capital confirmation certificate, and any supporting materials. Registration fees vary by canton, generally ranging from CHF 600 to CHF 2,000. The process takes 5 to 15 business days, depending on the complexity and the canton. Expedited services are available for those requiring faster registration. Upon completion, the LLC is officially recognized and listed in the public database, signifying its legal establishment.

Step 4: VAT Registration and Tax Compliance

If the LLC’s annual turnover exceeds CHF 100,000, VAT registration is mandatory. The application must be submitted to the Swiss Federal Tax Administration, ensuring the company is authorized to collect and remit VAT. In addition, Swiss law requires LLCs to maintain detailed financial statements, including a balance sheet and profit and loss account. These records must be updated annually to comply with tax and accounting regulations, ensuring transparency and proper tax reporting.

Step 5: Enroll Employees in Social Security

If the LLC employs staff, it must register them with the Swiss social security system. This includes contributions to old-age and survivors’ insurance, disability insurance, accident insurance, and unemployment insurance. Registration is conducted through the Cantonal Social Security Office (Ausgleichskasse). This step ensures compliance with Swiss employment laws while providing employees with essential social benefits and protections.

Completing these steps ensures that your LLC is fully compliant with Swiss laws and regulations. While the process can be complex, understanding the requirements and working with professionals can simplify the journey and help establish a strong foundation for your business in Switzerland.

Key Considerations for LLC Formation in Switzerland

When forming an LLC in Switzerland, several important aspects must be carefully planned and executed to ensure compliance with legal requirements and the long-term success of your business.

Choosing a Name and Domiciliation

The name of your LLC is an essential element of its identity and must meet specific legal criteria. The company name must include the suffix “GmbH” (in German-speaking regions) or “Sàrl” (in French-speaking regions) to indicate its legal structure. Additionally, the name cannot be misleading or conflict with existing business names registered in Switzerland. A search on the Zefix.ch website, the official Swiss Commercial Registry portal, can confirm the availability of your chosen name.

The choice of your company’s domicile also carries significant implications, particularly for taxation. Switzerland’s tax system includes federal, cantonal, and communal taxes, and the domicile determines the applicable cantonal and local tax rates. Entrepreneurs are advised to consult with tax professionals or fiduciary services to select a location that aligns with their business needs and tax optimization goals. While it is possible to change the domicile after registration, this process involves additional administrative steps.

Management and Governance

Effective management and governance are critical for the success of an LLC. At least one managing director must reside in Switzerland, ensuring that the company has a legal representative who can fulfil administrative duties and serve as a point of contact for Swiss authorities. This person does not need to be a Swiss citizen but must hold a valid residence or work permit.

The shareholders collectively form the Partners’ Assembly, the primary decision-making body of the LLC. The assembly appoints managing directors, approves financial statements, and makes strategic decisions, such as changes to the Articles of association. Clear delineation of roles and responsibilities among directors and shareholders is vital to prevent conflicts and ensure smooth operations. Many companies formalize these agreements in a shareholders’ agreement.

Funding and Shareholders

LLCs offer flexibility when it comes to funding and shareholder participation. The minimum share capital of CHF 20,000 can be increased at any time, allowing for greater financial resources and scalability. Adding new shareholders or investors is a straightforward process, though it may require amendments to the articles of association and an update to the Commercial Register.

Shareholders’ rights and responsibilities are clearly defined by Swiss law. Shareholders can vote on major decisions and are entitled to dividends proportional to their shares. However, they are also listed publicly in the Commercial Register, which may affect privacy. Despite the public listing, shareholders are shielded from personal liability beyond their capital contributions. This makes the LLC an attractive option for investors looking to minimize risk while maintaining influence over the business.

By addressing these key considerations—company name and domicile, management structure, and shareholder roles—you can create a solid foundation for your LLC in Switzerland. Taking the time to understand these aspects not only ensures legal compliance but also positions your business for long-term success in one of the world’s most dynamic economic environments.

Costs and Taxation of an LLC in Switzerland

Understanding the costs and taxation framework of a Limited Liability Company (LLC) is critical for planning and operating your business effectively. Below, we break down the key financial considerations associated with setting up and running an LLC in Switzerland.

Breakdown of Setup Costs

Establishing an LLC in Switzerland involves a combination of mandatory fees and optional expenses, depending on the complexity of the business structure and professional services engaged during the process.

- Notary Fees: Drafting and notarizing the Articles of Association and other incorporation documents typically costs between CHF 700 and CHF 2,000, depending on the notary and the canton.

- Commercial Register Fees: Registering the LLC with the Commercial Register incurs fees ranging from CHF 600 to CHF 2,000, depending on the share capital and canton-specific requirements.

- Legal and Consultancy Fees: Engaging legal or fiduciary advisors for support during the setup process may add an additional CHF 1,000 to CHF 3,000.

- Additional Costs: Costs for opening an escrow account, obtaining certified translations, and legalizing signatures may vary but are generally moderate.

The total setup costs for an LLC typically range from CHF 3,000 to CHF 5,000, depending on the scope of professional services and the complexity of the incorporation process.

Overview of Taxation for LLCs

Switzerland’s tax system for LLCs includes corporate taxation at federal, cantonal, and municipal levels, as well as additional tax considerations for shareholders.

- Corporate Income Tax: Swiss LLCs are subject to corporate income tax on their net profits. The federal tax rate is 8.5%, and combined cantonal and municipal tax rates range from 11.5% to 24%, depending on the domicile.

- Value Added Tax (VAT): If an LLC’s annual revenue exceeds CHF 100,000, it must register for VAT. The standard VAT rate is 7.7%, with reduced rates for certain goods and services. VAT-registered businesses must collect and remit VAT and can claim input VAT on business expenses.

- Wealth Tax for Shareholders: Shareholders must declare their ownership stake in the LLC as part of their personal wealth, which is subject to cantonal wealth tax. The tax rates vary by canton but are generally low.

Explanation of Double Taxation and Mitigation Strategies

One of the main challenges for LLC shareholders in Switzerland is double taxation. The company pays corporate income tax on its profits, and shareholders are taxed again on income received from the LLC, such as dividends or salaries. This can reduce the overall profitability of the business.

To mitigate the impact of double taxation, careful financial planning is essential. Some strategies include:

- Optimizing Salaries and Dividends: Balancing the distribution of income between salaries and dividends can help minimize the tax burden. Salaries are deductible for corporate tax purposes, reducing the taxable profit of the LLC.

- Tax Planning by Domicile: Choosing a canton with lower corporate tax rates can significantly reduce the overall tax burden. Engaging a tax consultant can help identify the most advantageous location.

- Retained Earnings: Retaining profits within the company for reinvestment can defer taxation, as dividends are only taxed when distributed.

Understanding the costs and tax implications of an LLC in Switzerland allows entrepreneurs to make informed decisions and maintain financial stability. By planning for setup expenses, leveraging tax benefits, and adopting smart financial strategies, your LLC can operate efficiently in Switzerland’s highly competitive business environment.

Compliance and Maintenance of an LLC in Switzerland

To ensure ongoing legal compliance and smooth operations, Limited Liability Companies (LLCs) in Switzerland must adhere to specific accounting, auditing, and financial management requirements. These obligations are vital for maintaining the company’s credibility and avoiding legal complications.

Accounting and Audit Requirements

Swiss law mandates that LLCs maintain detailed financial records to provide an accurate overview of the company’s financial health. The level of auditing required depends on the size and scope of the business.

- Limited Audit: Most small and medium-sized LLCs are subject to a limited audit, which focuses on verifying specific aspects of the company’s financial statements. LLCs with fewer than 10 full-time employees can even opt out of this requirement, provided all shareholders agree.

- Ordinary Audit: LLCs must undergo an ordinary audit if they exceed two of the following thresholds during two consecutive fiscal years: a balance sheet total of CHF 20 million, a turnover of CHF 40 million, or 250 full-time employees. Publicly traded LLCs or those preparing consolidated accounts are also subject to this more comprehensive audit, which examines all financial records in detail.

Ensuring compliance with these auditing requirements is crucial for legal adherence and fostering trust among investors, creditors, and business partners.

Annual Reporting Obligations

LLCs are required to prepare and submit annual financial statements, which typically include a balance sheet, profit and loss account, and accompanying notes. These documents must comply with Swiss accounting standards, such as the Swiss Code of Obligations or International Financial Reporting Standards (IFRS), depending on the company’s size and operational scope.

Annual reports must be submitted to the shareholders for approval during the general meeting and, in certain cases, filed with the Commercial Register. Maintaining transparency and accuracy in financial reporting helps ensure the company meets its tax obligations and demonstrates reliability to stakeholders.

Reserve Allocation and Dividend Distribution

Swiss law requires LLCs to allocate a portion of their annual profits to statutory reserves before distributing dividends to shareholders. This practise ensures that the company maintains financial stability and can cover potential losses.

- Statutory Reserves: At least 5% of the company’s annual net profit must be allocated to reserves until they reach 20% of the registered share capital. This reserve can only be used under specific conditions, such as offsetting losses or legal dissolution.

- Dividend Distribution: Dividends can only be declared and distributed after statutory and voluntary reserves have been allocated. Shareholders must approve the proposed dividend distribution during the general meeting.

By adhering to these reserve and dividend rules, LLCs can maintain financial health and comply with Swiss regulations.

By meeting these compliance and maintenance requirements, LLCs in Switzerland can operate efficiently and maintain a strong reputation in the business community. Ensuring proper accounting practises, fulfilling annual reporting obligations, and managing reserves responsibly are essential for long-term success and legal adherence.

Why Choose an LLC for Your Business in Switzerland? Recommendations from ALPINEGATE Business Advisors

At ALPINEGATE Business Advisors, we’ve guided countless entrepreneurs through the process of establishing their businesses in Switzerland. Among the various options available, the Limited Liability Company (LLC) consistently stands out as a versatile, secure, and credible choice. Here’s why we recommend this structure for many of our clients.

Flexibility for SMEs and Family-Owned Businesses

For small and medium-sized enterprises (SMEs) and family-owned businesses, the LLC offers an ideal combination of simplicity and adaptability. With a relatively low capital requirement of CHF 20,000, forming an LLC is accessible for businesses with modest starting budgets. Moreover, the ability to have a single shareholder or multiple partners allows entrepreneurs to tailor the structure to their needs, whether starting solo or collaborating with investors and family members.

The LLC also provides flexibility in its governance. Adding new shareholders or restructuring management is straightforward, making it easier for businesses to scale as they grow. At ALPINEGATE, we’ve seen how this adaptability enables entrepreneurs to stay competitive in Switzerland’s ever-changing economic landscape.

Credibility and Security in a Competitive Market

Switzerland’s reputation for stability and precision is reflected in the LLC structure, which offers both legal security and market credibility. As a separate legal entity, an LLC shields shareholders’ personal assets from business liabilities, reducing financial risk in the event of unforeseen challenges.

Additionally, an LLC’s presence in the Swiss Commercial Register enhances its reputation. This public listing demonstrates compliance with Swiss legal and financial standards, giving customers, investors, and partners confidence in your company’s professionalism and reliability. At ALPINEGATE, we emphasize how this credibility can open doors to partnerships and growth opportunities, both domestically and internationally.

Advantages for Both Local and International Entrepreneurs

Whether you’re a Swiss resident or an international entrepreneur, the LLC offers distinct benefits. For local entrepreneurs, it combines the protection of limited liability with operational simplicity, making it a top choice for businesses ranging from startups to established SMEs.

For international entrepreneurs, Switzerland’s LLC structure is particularly accommodating. Foreign nationals can fully own an LLC, and only one managing director needs to reside in Switzerland. This makes it possible to establish a strong presence in Switzerland’s business ecosystem without significant relocation. At ALPINEGATE, we guide international clients through these nuances, ensuring smooth compliance with residency and governance requirements.

The LLC’s combination of flexibility, security, and credibility makes it a standout choice for businesses in Switzerland. At ALPINEGATE Business Advisors, we specialize in helping entrepreneurs make informed decisions about the best structure for their needs. Whether you’re launching a new venture or expanding internationally, we’re here to support you every step of the way. Let’s build your success story together.

Conclusion

Establishing a Limited Liability Company (LLC) in Switzerland is an excellent choice for entrepreneurs seeking a balance of flexibility, legal security, and market credibility. While the process involves navigating several legal and administrative requirements, the benefits—such as limited liability, tax advantages, and the ability to scale—make it a worthwhile investment. Challenges like higher setup costs and double taxation can be managed effectively with proper planning and professional guidance.

At ALPINEGATE Business Advisors, we understand that every business journey is unique. Our team of experts is dedicated to helping entrepreneurs navigate the complexities of LLC formation in Switzerland, tailoring solutions to match your vision and goals. Whether you’re a local entrepreneur or an international investor, we’re here to provide comprehensive support at every stage of the process. Let us help you turn your business aspirations into reality.

FAQ: Creating a Limited Liability Company (LLC) in Switzerland

What is the minimum capital requirement for an LLC in Switzerland?

To establish an LLC in Switzerland, the minimum share capital required is CHF 20,000. This amount must be fully paid into an escrow account before registration. Once the company is officially registered, the capital can be used for business operations. This relatively low capital requirement makes the LLC an accessible option for many entrepreneurs, particularly small and medium-sized enterprises.

Can a foreigner create an LLC in Switzerland?

Yes, foreigners can fully own an LLC in Switzerland. However, at least one managing director must reside in Switzerland, ensuring local representation and compliance with Swiss legal requirements. The managing director doesn’t need to be a Swiss citizen but must have a valid residence or work permit. At ALPINEGATE, we guide international clients through these residency requirements to ensure smooth incorporation.

How long does it take to register an LLC in Switzerland?

The registration process for an LLC in Switzerland typically takes between 5 to 15 business days after all required documents are submitted to the Commercial Register. The timeline can vary depending on the canton and the completeness of the application. Additional time may be needed to prepare and notarize documents, open the escrow account, and gather other necessary materials. ALPINEGATE offers tailored support to expedite the process and ensure all requirements are met efficiently.

What are the main tax obligations for an LLC in Switzerland?

An LLC in Switzerland is subject to corporate income tax, which includes federal, cantonal, and municipal levels. The combined tax rate varies between 11.5% and 24%, depending on the canton. If the company’s annual turnover exceeds CHF 100,000, it must also register for VAT. Additionally, shareholders must report their ownership stake in the LLC for wealth tax purposes. Double taxation can occur, but proper financial planning can help minimize its impact.

What are the ongoing compliance requirements for an LLC?

LLCs must maintain accurate financial records and prepare annual financial statements, including a balance sheet and profit and loss account. Depending on the company’s size, it may also need to undergo a limited or ordinary audit. Additionally, at least 5% of the annual net profit must be allocated to statutory reserves until the reserve reaches 20% of the share capital. Meeting these requirements ensures the LLC operates transparently and complies with Swiss legal and financial standards.