Revenue is a fundamental concept in accounting, representing the total sales of goods or services made by a company over a specific period. It’s a key metric that provides insight into the business’s capacity to generate income, serving as the foundation for understanding a company’s financial performance. Revenue is often referred to as the “top line” of the income statement, highlighting its role as the starting point for evaluating overall profitability.

In the context of Switzerland, understanding revenue is particularly important for businesses due to the specific market dynamics and regulatory environment. Swiss companies, ranging from small enterprises to large multinational corporations, rely on revenue not only to measure their success but also to navigate financial planning, tax obligations, and compliance with local standards. Revenue acts as a critical indicator of business health, helping stakeholders—such as investors, creditors, and management—assess operational efficiency and make informed strategic decisions.

In this article, we will explore the definition of revenue, and its calculation, and provide practical examples to give a comprehensive understanding of how revenue functions in financial accounting, particularly within the Swiss business environment.

Definition of Revenue

Revenue, often referred to as sales or turnover, is the total income generated by a company through the sale of goods or services over a specific period. It reflects the effectiveness of a company in turning its products or services into income. Revenue is crucial as it forms the basis from which other financial metrics, such as profit and growth, are derived. Typically, it is calculated annually, quarterly, or monthly, depending on the reporting practices of the company.

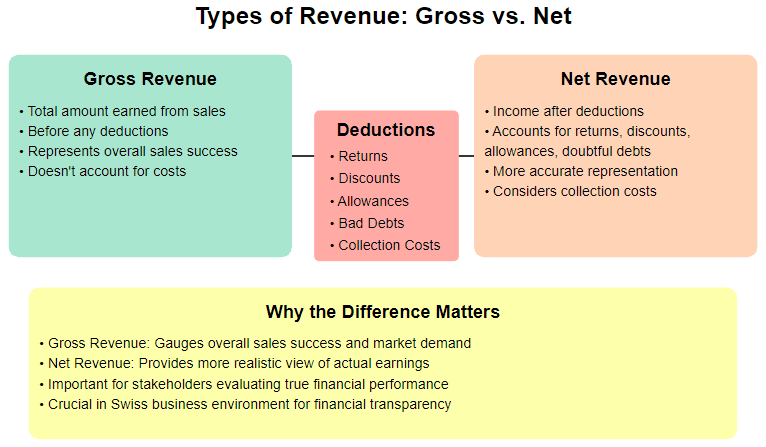

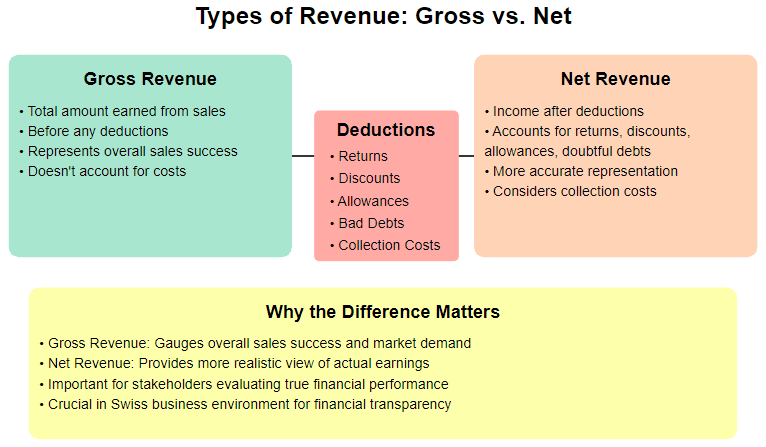

Gross Revenue vs. Net Revenue

To fully understand revenue, it’s important to distinguish between “gross” and “net” revenue. Gross revenue represents the total amount earned by a company before any deductions, such as returns, discounts, or allowances. Essentially, it is the sum of all sales generated without accounting for any expenses or adjustments. Gross revenue is useful for understanding the overall scale of a company’s sales activities.

On the other hand, net revenue is the amount that remains after subtracting sales returns, discounts, and allowances from gross revenue. It provides a more realistic view of the actual income that the company retains after customer-related adjustments. Net revenue helps in assessing the quality of sales and the impact of customer incentives or returns on the business.

VAT Considerations in Switzerland

Another crucial aspect of revenue accounting in Switzerland is the inclusion of value-added tax (VAT). In Swiss accounting practices, revenue can be reported either including VAT (TTC) or excluding VAT (HT). VAT is a consumption tax applied to the sale of goods and services, which businesses collect from customers on behalf of the government. Learn more about our accounting services in Switzerland.

Reporting revenue including VAT represents the total amount received from sales, including the tax portion that is ultimately not kept by the company. Revenue excluding VAT provides a clearer picture of the income generated purely from sales, without the tax component, and is typically used for internal analysis and comparisons across different periods or companies. In Switzerland, VAT rates are relatively low compared to other European countries, currently set at 8.1%, which impacts how revenue calculations are approached, especially when comparing Swiss companies to those in neighbouring countries.

Understanding the distinction between gross and net revenue, as well as the implications of VAT, is crucial for accurately interpreting a company’s sales figures and financial health. In the Swiss business landscape, these distinctions become particularly significant given the emphasis on precise financial reporting and regulatory compliance.

Types of Revenue: Gross vs. Net

Understanding the types of revenue is essential for accurately evaluating a company’s financial health. The two main types of revenue are gross revenue and net revenue, each offering different insights into a company’s sales and profitability.

Gross Revenue

Gross revenue refers to the total amount earned from the sale of goods or services before any deductions. It represents all income generated through the company’s sales efforts, providing an overall picture of how much the company brought in without accounting for any specific costs or adjustments. This figure is valuable for understanding the scale and success of a company’s sales activities at a high level. For instance, it can help stakeholders gauge market demand and the company’s ability to reach customers.

However, gross revenue alone doesn’t tell the whole story, as it doesn’t account for costs that can significantly impact profitability. This is where net revenue comes into play.

Net Revenue

Net revenue is the income that remains after subtracting certain deductions from gross revenue. These deductions typically include sales returns (products returned by customers), discounts offered to customers, and allowances for damaged or defective goods. By excluding these items, net revenue gives a clearer and more accurate representation of how much money the company truly earned from its sales activities.

Additionally, doubtful debts and collection costs are also considered when calculating net revenue. Doubtful debts are amounts that the company expects may never be paid by customers. These often occur due to customers facing financial difficulties or disputes over delivered products or services. By factoring in doubtful debts, net revenue accounts for potential losses from customers who are unlikely to settle their accounts.

Similarly, collection costs are expenses incurred in trying to collect overdue payments from customers. These can include administrative fees, legal costs, or expenses associated with hiring collection agencies. Deducting these costs from gross revenue ensures that the net revenue more accurately reflects the actual income that a company can rely upon, as opposed to the theoretical maximum that includes potential bad debts.

Why the Difference Matters

The difference between gross and net revenue is crucial for stakeholders who need to evaluate the company’s true financial performance. Gross revenue is useful for gauging overall sales success, but net revenue provides a more realistic view of the money actually earned after adjusting for the costs associated with sales. For investors and creditors, net revenue offers a clearer indicator of the company’s ability to generate sustainable income.

In the Swiss business environment, where financial transparency and precision are emphasized, understanding the difference between gross and net revenue is essential for making informed decisions. Businesses operating in Switzerland must account for not only market demand but also potential risks related to customer payments, ensuring that the reported net revenue aligns with actual financial conditions.

How to Calculate Revenue

Calculating revenue is a fundamental aspect of understanding a company’s financial performance. Revenue is typically calculated using the following simple formula:

Revenue = Unit Sale Price x Quantity Sold

This formula applies to any type of business, whether it sells products, services, or a combination of both. By multiplying the price per unit of product or service by the quantity sold, a company can determine the total income generated over a given period. However, the application of this formula can vary depending on the industry and the type of business activity.

Below, we provide examples of how revenue is calculated in different industries in Switzerland, covering both service and manufacturing sectors. To better illustrate these calculations, we have summarized the examples in the table below:

| Sector | Example | Calculation | Insights |

| Manufacturing | Furniture Production | Revenue = CHF 150 (Unit Sale Price) x 500 (Quantity Sold) = CHF 75,000 | Shows effectiveness of sales strategy and market demand. |

| Service | Accounting Firm | Revenue = CHF 200 (Hourly Rate) x 300 (Hours Provided) = CHF 60,000 | Demonstrates how revenue depends on hours worked and rate charged. |

| Tourism | Ski Resort | Revenue = CHF 80 (Price per Day Pass) x 1,500 (Passes Sold) = CHF 120,000 | Reflects seasonal nature and peak demand impact. |

| Retail | Grocery Store | Revenue = CHF 3 (Price per Loaf) x 10,000 (Loaves Sold) = CHF 30,000 | Helps with inventory management and product contribution analysis. |

This table helps visualize the revenue calculation process across various industries, providing practical insights into how these calculations can impact business strategy and financial analysis.

Manufacturing Sector: Furniture Production

Consider a Swiss furniture manufacturer that produces and sells high-quality wooden chairs. If the unit sale price for a chair is CHF 150, and the company sells 500 chairs in a given month, the revenue can be calculated as follows:

Revenue = CHF 150 (Unit Sale Price) x 500 (Quantity Sold) = CHF 75,000

In this example, the revenue of CHF 75,000 represents the total sales income generated from selling the chairs. This calculation gives the company insight into the effectiveness of its sales strategy and market demand for its products.

Service Sector: Accounting Firm

An accounting firm in Zurich charges CHF 200 per hour for financial consulting services. If the firm provides 300 hours of consulting services in a month, the revenue calculation would be:

Revenue = CHF 200 (Hourly Rate) x 300 (Hours Provided) = CHF 60,000

For service-based businesses like accounting firms, revenue is derived from the total hours billed at the hourly rate. This example demonstrates how revenue in service industries depends on the volume of hours worked and the rate charged per hour.

Tourism Sector: Ski Resort

The Swiss tourism sector is also a significant part of the economy, especially with popular destinations like ski resorts. Consider a ski resort in the Alps that sells day passes for CHF 80. If 1,500 day passes are sold during the month of January, the revenue would be:

Revenue = CHF 80 (Price per Day Pass) x 1,500 (Passes Sold) = CHF 120,000

The revenue calculation for the ski resort helps understand the income generated from the services offered to tourists, reflecting both the seasonal nature of the business and the high demand during peak months.

Retail Sector: Grocery Store

In the retail sector, consider a grocery store in Geneva that sells a range of products, including daily essentials like bread. If a loaf of bread is sold for CHF 3, and the store sells 10,000 loaves in a month, the revenue for bread sales is:

Revenue = CHF 3 (Price per Loaf) x 10,000 (Loaves Sold) = CHF 30,000

For grocery stores, calculating revenue for each product line allows for better inventory management and helps identify which products contribute the most to total sales.

Why Understanding Revenue Calculation Matters

Calculating revenue accurately is critical for any business, regardless of its size or industry. It helps in understanding the sales trends, planning future strategies, and assessing the overall health of the business. For Swiss companies, revenue calculations not only provide insights into the market’s demand but also serve as a basis for tax calculations and compliance with financial reporting standards.

By understanding how to calculate revenue for different industries, businesses can make informed decisions, identify their most profitable products or services, and adapt strategies accordingly to maximize their income. In a market like Switzerland, where the cost of doing business is high, accurate revenue calculations are vital to maintaining profitability and competitiveness.

The Importance of Revenue in Financial Analysis

Revenue plays a central role in assessing a company’s financial health. It provides the foundation for many other financial metrics and is often one of the first indicators stakeholders—such as investors, creditors, and management—look at to evaluate a company’s performance. Revenue is also referred to as the “top line” because it sits at the very top of the income statement, reflecting the total income from a company’s core business activities before any expenses are deducted. In essence, revenue helps illustrate how effectively a company is generating sales and serving its market.

Revenue as an Indicator of Financial Health

Revenue is crucial for assessing a company’s overall market performance. It shows how successful a business is at attracting customers and converting that attention into sales. A growing revenue stream generally signals increased market share, stronger brand recognition, and effective sales strategies, all of which are important for a company’s stability and growth prospects.

In Switzerland, where transparency and stability are valued, companies are expected to demonstrate consistent revenue growth to assure stakeholders of their competitiveness. Revenue also plays a key role in assessing a company’s ability to fund its operations, reinvest in growth, pay off debts, and provide returns to shareholders. It forms the starting point for calculating other important financial metrics, such as gross margin and operating profit, which further break down the company’s profitability and cost structure.

Revenue vs. Profit: The Bigger Picture

Although revenue is a vital metric, it does not provide a complete picture of a company’s financial health. High revenue does not necessarily equate to high profitability. This is because revenue represents the total income from sales, but does not account for company expenses and liabilities that are subtracted to determine profitability.

Consider the following factors:

- Operating Expenses: A company might generate substantial revenue but incur high costs in the form of salaries, rent, utilities, marketing, and administrative expenses. If these operating expenses are greater than the revenue generated, the company will experience losses, regardless of how high its revenue might be.

- Cost of Goods Sold (COGS): Businesses that manufacture or sell goods must also consider the cost of goods sold. This includes the direct costs related to producing or purchasing the products they sell. If the COGS is too high, the company’s gross margin will be significantly reduced, which can impact overall profitability.

- Debt and Liabilities: Revenue alone does not reflect a company’s liabilities. A company may have high sales, but if it is also heavily in debt, servicing those debts will reduce profitability. High-interest payments, for instance, can diminish net profit even if revenue appears strong.

- One-Off Sales and Seasonal Variability: Revenue can sometimes be inflated by one-time events, such as large contracts or seasonal peaks. For example, a Swiss ski resort may have high revenue during the winter season but may struggle to maintain profitability during off-peak periods. Therefore, consistent revenue streams, adjusted for seasonality, are a more reliable indicator of long-term stability.

Understanding the Bigger Picture: Revenue and Profitability

To truly assess a company’s financial health, revenue must be considered alongside other metrics such as gross profit, operating income, net profit, and cash flow. Only by analyzing the relationship between revenue and these other indicators can stakeholders form a comprehensive view of how well the company is managing its resources, controlling costs, and ultimately converting revenue into profit.

For instance, a company may report CHF 1 million in revenue, but if its operating expenses and COGS total CHF 950,000, the net profit is only CHF 50,000. In contrast, another company with CHF 700,000 in revenue but lower operating costs and liabilities may end up with a higher net profit. Thus, while revenue provides insight into the company’s market activity, it must always be balanced against the associated costs and liabilities to assess the company’s true profitability.

In the Swiss business landscape, where accuracy and financial prudence are highly valued, understanding this balance is crucial for decision-making. Companies must strive for both high revenue and efficient cost management to achieve sustained growth and financial stability. Stakeholders need to consider not just how much money is coming in, but also how much is being retained after all expenses, ensuring a realistic understanding of a company’s financial health.

Comments from ALPINEGATE Business Advisors

At ALPINEGATE Business Advisors, we have seen firsthand how crucial a deep understanding of revenue is for Swiss businesses. Revenue not only drives growth but also forms the basis for critical decisions related to investments, resource allocation, and strategic planning. Swiss companies, particularly those navigating a competitive landscape, need to ensure that their revenue figures are analyzed with precision, taking into account local tax regulations and the high cost of operations.

We work closely with our clients to not only analyze revenue but also develop tailored strategies that align revenue growth with effective cost management. Our goal is to ensure that companies are not just increasing their sales numbers, but also optimizing their overall financial health through careful analysis of profit margins, cost structures, and sustainable practices. Our expertise lies in helping businesses bridge the gap between high revenue and high profitability, ensuring financial stability in the Swiss market.

Forecasting Revenue in a Business Plan

Forecasting revenue is an essential component of developing a solid business plan, especially for startups that need to demonstrate their potential profitability and sustainability to investors and financial institutions. For businesses in Switzerland, effective revenue forecasting not only helps in planning growth strategies but also in understanding market dynamics, preparing for financial challenges, and ensuring compliance with financial standards.

The Importance of Revenue Forecasting for Startups in Switzerland

For startups in Switzerland, revenue forecasting serves as a roadmap to understanding the business’s financial journey. Accurate revenue forecasts are crucial for attracting investors, securing loans, and planning operations effectively. Investors and banks need to see credible forecasts that demonstrate the potential for revenue generation, and therefore profitability, over the coming months or years.

Forecasting revenue helps startups set financial goals, anticipate future income, and make informed decisions regarding production, staffing, marketing, and other business operations. Moreover, it provides a basis for budgeting and cash flow planning, which is vital for young businesses often operating with limited resources. In Switzerland, where operational costs can be high due to salaries, regulatory standards, and other expenses, having a clear view of expected revenue can help startups mitigate risks and allocate resources efficiently.

Accounting for Seasonality and Cyclicity

The Swiss market, with its diverse economy, often experiences fluctuations in demand throughout the year due to seasonal variations. This means that businesses must take into account the cyclicity of their sector when forecasting revenue. Some industries in Switzerland are especially prone to seasonal changes, and understanding these cycles is critical for realistic revenue forecasts.

For example:

- Winter Tourism: Switzerland is famous for its winter tourism, with ski resorts experiencing significant peaks in revenue during the winter months. Startups and businesses in the tourism and hospitality sector need to recognize these seasonal peaks and valleys when forecasting revenue. Predicting an influx of visitors during winter is crucial for managing inventory, staffing, and overall business strategy. Similarly, they must plan for lower activity during the off-season and prepare for reduced cash flow by budgeting appropriately or diversifying their offerings.

- Summer Festivals and Outdoor Activities: During the summer, Switzerland hosts numerous festivals and outdoor activities that drive revenue in the hospitality, event planning, and entertainment sectors. Companies in these industries need to forecast increased demand during the summer months and adjust their staffing, marketing campaigns, and inventory levels accordingly. Understanding the revenue generated during these peak periods and planning for quieter months ensures more sustainable cash flow management throughout the year.

- Agriculture and Food Production: Businesses involved in agriculture and food production must also consider seasonal variations. For instance, Swiss dairy producers may have varying revenue based on production cycles, market prices, and the availability of raw materials. Understanding these patterns helps companies plan for storage, production, and sales in a way that maximizes revenue while minimizing waste and cost inefficiencies.

Impact of Cyclicity on Revenue Forecasting

Cyclicity can have a significant impact on revenue forecasting, especially in sectors where demand is highly dependent on seasons or specific economic cycles. For Swiss startups, recognizing and accurately forecasting these cycles is crucial for establishing credibility in their business plans and ensuring sustainable operations.

To effectively manage seasonal revenue fluctuations, businesses can adopt several strategies, including:

- Diversification of Offerings: By diversifying products or services to address different customer needs throughout the year, companies can maintain a steady revenue stream. For instance, a ski resort could offer summer activities like hiking, mountain biking, or events to offset the reduced winter revenue.

- Scenario Planning: Using scenario planning to predict best-case, worst-case, and expected revenue helps businesses prepare for variability. This allows startups to plan for fluctuations, allocate resources efficiently, and set realistic financial expectations.

- Cash Flow Management: Careful cash flow planning is vital for businesses facing cyclic revenue patterns. During high-revenue months, companies should set aside funds to support operations during periods of lower income. This practice ensures that they remain financially healthy even when cash inflows are reduced.

Revenue forecasting is not just about predicting numbers; it’s about understanding the market dynamics that drive those numbers. For startups in Switzerland, where many sectors are influenced by seasonal activities, accurate forecasting requires taking into account both predictable cycles and broader market forces. By incorporating seasonality into revenue forecasts, startups can better prepare for both high and low periods, build investor confidence, and create a robust plan for long-term success.

Revenue and Variable Costs

Revenue is closely linked to a company’s costs, particularly variable costs, which change in direct proportion to the level of sales or production. Understanding the relationship between revenue and variable costs is crucial for effectively managing profitability. Variable costs are those expenses that vary with the company’s level of output or sales, such as raw materials, direct labour, and certain utilities. As revenue increases or decreases, variable costs tend to follow suit, which makes them an important factor in financial planning and analysis.

How Changes in Revenue Affect Variable Costs

Variable costs increase as a company sells more products or provides more services. This is because producing more goods or delivering additional services requires the use of more resources. Unlike fixed costs—such as rent or salaries—that remain constant regardless of production levels, variable costs change based on the volume of activity. Therefore, the higher the revenue generated from increased sales, the higher the corresponding variable costs.

The concept of cost-to-revenue relationship is important for businesses to understand how efficiently they are using their resources. If variable costs rise significantly with increased revenue, it may indicate inefficiencies in procurement, production, or supply chain management that could erode profit margins. On the other hand, effective management of variable costs can help businesses maintain or even increase profitability as they grow.

Examples of Revenue and Variable Costs in Different Sectors

To better illustrate how changes in revenue affect variable costs, let’s consider examples from different industries in Switzerland.

Supermarkets and Increased Food Sales

Consider a large supermarket chain in Switzerland that sees an increase in food sales during certain seasons, such as holidays or summer festivals. With this increase in sales, the supermarket must procure larger quantities of items like fruits, vegetables, dairy products, and other consumer goods. This leads to an increase in procurement costs, as the supermarket has to purchase more inventory to meet the rising demand.

For example, if the supermarket sells 10,000 cartons of milk in a regular month but demand rises to 15,000 cartons in December, the cost of purchasing additional cartons will increase proportionately. These procurement costs include purchasing the milk, transportation costs, and even additional storage costs if more warehouse space is needed. Thus, as revenue from increased sales grows, so do the variable costs associated with fulfilling that demand.

Hospitality Industry: Hotels During Peak Season

Another example can be found in the hospitality industry, such as a hotel in a popular Swiss tourist destination. During peak seasons like winter holidays or summer months, the hotel experiences higher occupancy rates, leading to increased revenue. However, the variable costs associated with this increased occupancy also rise. These costs might include additional cleaning supplies, increased utilities (such as water and electricity due to more guests), and higher staffing costs to manage the increased volume of guests.

For a hotel, understanding this relationship is essential for setting room rates that can adequately cover the increased variable costs while ensuring profitability. Hotels often adjust their pricing strategy during peak periods to compensate for these additional costs and capitalize on the high demand.

Manufacturing Industry: Swiss Chocolate Production

In the manufacturing sector, consider a Swiss chocolate producer that ramps up production before major holidays like Christmas or Easter. Increased demand for chocolate products during these periods leads to higher revenue. However, to meet this demand, the producer incurs additional variable costs, such as raw materials (cocoa, sugar, milk), packaging costs, and direct labour costs for extra shifts or overtime. The ability to manage these variable costs effectively is key to ensuring that the increase in revenue translates into higher profit, rather than just covering the cost of the additional production.

Implications of Revenue and Variable Cost Management

Effectively managing the relationship between revenue and variable costs is crucial for profitability. When revenue increases, companies need to ensure that their variable costs are controlled in such a way that profit margins are maintained or improved. If variable costs rise disproportionately to revenue, it could indicate that the company is struggling to scale efficiently.

For Swiss businesses, where operational costs are often higher due to stringent quality standards and high wages, optimizing the management of variable costs is particularly important. Businesses need to have a deep understanding of how different factors influence their variable costs and implement strategies such as bulk purchasing discounts, improved supply chain efficiencies, or better workforce planning to keep these costs manageable as revenue changes.

In summary, revenue growth is beneficial only when variable costs are effectively managed. By understanding how variable costs fluctuate with revenue, businesses can implement better cost-control measures and, in turn, ensure a sustainable path to profitability. This understanding is particularly important for companies operating in Switzerland, where market conditions require careful cost management to maintain competitiveness.

Examples of Revenue for Swiss Companies

To better understand how revenue plays a role in the financial health of large corporations, let’s look at some examples from prominent Swiss companies like Migros, Coop, and Nestlé. These companies are leaders in their respective sectors—retail and food production—and provide valuable insights into how revenue and profit are analyzed, as well as how accounting practices in Switzerland are applied to reflect their financial performance.

Migros

Migros is one of Switzerland’s largest retail companies, known for its cooperative structure and wide array of products ranging from groceries to electronics. In 2021, Migros reported a revenue of CHF 28.9 billion. This revenue figure represents all the income generated through its various business divisions, including supermarkets, online stores, and services such as fitness centres.

Despite generating substantial revenue, Migros reported a net profit of CHF 668 million. This disparity between revenue and profit is due to several factors, including the cost of goods sold (COGS), operational expenses, and investments in infrastructure and personnel. Migros’ financial statements highlight how gross revenue from sales is significantly reduced after accounting for costs such as supplier payments, wages for employees, and other operating expenses. This highlights the importance of cost efficiency and effective expense management in transforming high revenue into meaningful profit.

Coop

Coop, another major player in the Swiss retail sector, is known for its widespread presence across the country, offering groceries, hardware, and services. In 2021, Coop achieved total revenue of CHF 31.9 billion, with CHF 19.6 billion attributed specifically to its retail activities. Coop’s revenue figures illustrate the company’s broad customer base and its ability to generate substantial income from diverse sources.

However, the net profit for Coop stood at CHF 559 million in the same year, indicating that a significant portion of its revenue was absorbed by operating expenses, including supply chain costs, employee salaries, and rent for numerous retail locations. Coop’s financial statements are a good example of Swiss accounting practices, where transparency is key, and expenses are clearly categorized to provide a realistic picture of profitability. Coop, much like Migros, must navigate high operating costs, which significantly impact net profitability despite strong revenue figures.

Nestlé

Nestlé is a global leader in food and beverages, with its headquarters in Switzerland. The company reported revenue of CHF 87.1 billion in 2021, a testament to its strong international presence and extensive product portfolio. Unlike Migros and Coop, which primarily operate within Switzerland, Nestlé’s revenue is derived from its operations across multiple markets worldwide, including Europe, North America, and Asia.

Nestlé’s net profit in 2021 was CHF 16.9 billion, indicating a relatively high profit margin compared to other large Swiss companies. Nestlé’s ability to convert a substantial portion of its revenue into profit is largely due to its global supply chain efficiencies, strong brand recognition, and strategic cost management. By optimizing production processes and leveraging economies of scale, Nestlé effectively manages its variable and fixed costs, thereby enhancing its overall profitability.

Comparing Revenue and Profit: Key Insights

The comparison between Migros, Coop, and Nestlé highlights several key insights into how revenue and profit interact, particularly within the Swiss context:

- Revenue Size vs. Profitability: All three companies generate high revenues, but their ability to convert this revenue into profit varies significantly. Nestlé’s higher profit margin compared to Migros and Coop demonstrates the importance of scale and cost management. While Migros and Coop primarily operate in a high-cost domestic market, Nestlé’s international presence allows it to capitalize on more efficient production and distribution processes.

- Cost Efficiency: Migros and Coop face significant costs associated with running physical retail locations across Switzerland, which includes include high wages, rent, and logistics. These costs, while necessary for operations, impact the bottom line. Nestlé, on the other hand, benefits from a global scale, allowing it to better manage production costs and supply chain expenses, which positively impacts profitability.

- Accounting Practices in Swiss Financial Statements: Swiss companies are known for their transparent and detailed financial reporting. The financial statements of Migros, Coop, and Nestlé all adhere to Swiss accounting standards that require clear categorization of revenues, costs, and expenses. This transparency helps stakeholders understand how revenue is generated and used, whether it is reinvested into operations or distributed as profit.

For investors and stakeholders, examining both revenue and profit is crucial. High revenue is an indication of market reach and demand, but profitability reflects the company’s efficiency in managing its costs. The examples of Migros, Coop, and Nestlé underscore the importance of not just focusing on revenue growth but also understanding the costs involved in generating that revenue, particularly in a high-cost environment like Switzerland.

Overall, the financial performance of these companies illustrates the broader dynamics of the Swiss business landscape—where generating substantial revenue is only part of the challenge, and managing costs effectively is equally, if not more, critical to achieving sustainable profitability.

Conclusion: The Importance of Understanding Revenue for Entrepreneurs

Revenue is a fundamental aspect of assessing a company’s financial health, acting as the starting point for understanding sales performance and market reach. For entrepreneurs, having a clear understanding of revenue is crucial to evaluate how effectively the business is generating income and to identify growth opportunities. However, it is important to remember that revenue alone does not provide a complete picture—high sales figures do not always translate to profitability. Entrepreneurs must complement revenue analysis with other financial indicators, such as profit margins, operating expenses, and cash flow, to gain a comprehensive understanding of the company’s financial stability and efficiency.

At ALPINEGATE Business Advisors, we understand the complexities of financial analysis and the importance of a balanced approach to evaluating business performance. Our services are designed to help businesses in Switzerland navigate their financial challenges, from revenue forecasting to profit analysis and cost management. With our expertise, we support entrepreneurs in making informed decisions that drive sustainable growth and financial health.

FAQ on Revenue in Accounting

What is Revenue and How is It Used?

Revenue is the total income that a company generates from selling goods or providing services over a specific period. Often called the “top line,” it appears at the top of a company’s income statement. Revenue serves as a primary indicator of a company’s ability to generate sales and reflects business activity and growth. It is used by investors, creditors, and management to assess the company’s financial performance, market demand, and overall business health. Rising revenue generally indicates an expanding customer base and increasing market share, while management uses revenue figures to forecast growth and set strategic goals.

How is Revenue Calculated, and What is the Difference Between Revenue Excluding VAT and Including VAT?

Revenue is typically calculated by multiplying the unit sale price by the quantity sold. In service industries, revenue may be calculated by multiplying the hourly rate by the number of hours billed. This straightforward calculation helps determine the total income generated from a company’s sales activities.

In Swiss accounting, revenue can be reported excluding VAT (HT) or including VAT (TTC). Revenue excluding VAT represents the total sales income before value-added tax is added, providing a clear picture of the income generated directly from sales without the tax component. On the other hand, revenue including VAT reflects the total amount received from sales, including the tax charged to customers. Since VAT must be remitted to the Federal Tax Administration, revenue-excluding VAT is often more useful for internal financial analysis, as it represents the actual earnings available to the company.

Why Does Financial Analysis Based Solely on Revenue Require Caution?

While revenue is an important metric, financial analysis based solely on revenue can be misleading. High revenue does not necessarily mean that a company is profitable. Revenue only reflects total sales, but it does not account for the costs incurred in generating those sales. A company may have significant revenue but still be unprofitable if operating costs, such as salaries, rent, raw materials, and other expenses, exceed the income generated. Therefore, to obtain a complete picture of a company’s financial health, revenue must be analyzed alongside other metrics, such as gross profit, net profit, and cash flow. These metrics help determine whether the company is managing its costs effectively and converting revenue into sustainable profit.